is there real estate transfer tax in florida

Documents that transfer an interest in Florida real property such as deeds. There are also special tax districts such as schools and water management districts that.

Since there is no other consideration for the transfer.

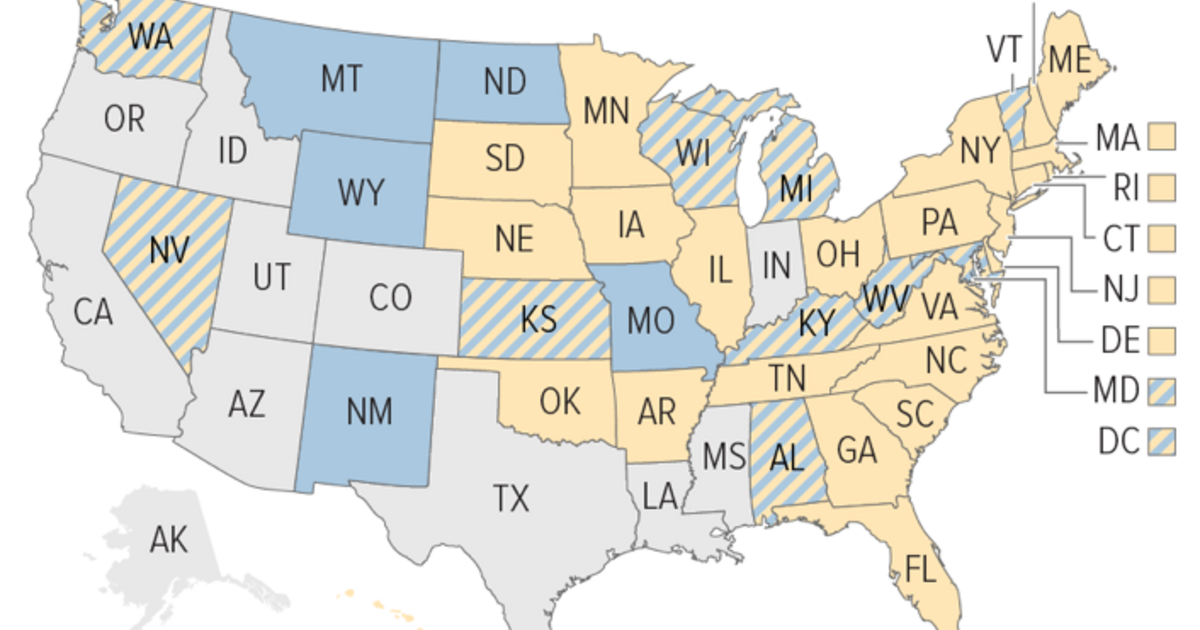

. The average price for real estate on Bordage St is 4530. The District of Columbia reduces its deed recordation tax for first-time homebuyers to 0725 for values up to 400000. The average property tax rate in Florida is 083.

Charles Avenue New Orleans LA 70130 Phone. Tax is paid to the Clerk of Court. The Florida documentary stamp tax is applied at a rate of 070 per 100 paid for the property in every.

The tax rate for documents that transfer an interest in real property is 70 per 100 or portion thereof of the total consideration paid or to be paid for the transfer. For the purposes of determining. In all Florida counties other than Miami-Dade County the stamp tax owed is 70 per 100 or a rate of 07.

1777 Kristy Pierce to Ralph Hartman 8136 South River Road Blue. The rate is equal to 70 cents per 100 of the deeds consideration. If passed this new transfer tax would be 20 for amounts over 2.

1776 Matthews Muskingum County Real Estate LLC to Leon Draughn 20 West King St Zanesville 30000. There may be recording fees documentary stamp taxes or gift tax reporting requirements for some transfers. The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance.

The Florida documentary stamp tax is a real estate transfer tax. The consideration is rounded up to the nearest increment of 100. Individuals who transfer real.

In Florida there are two distinct transfer tax rates. 138 Narragansett Ave Unit 11 652900 Buyer Cathy Roheim T Cathy Roheim Tr Seller Clifford Kurz Susan Kurz 104 Steamboat St 640000 Buyer Roger A. If the property is within Miami-Dade county the transfer tax is 06 of the sale price.

Each county sets its own tax rate. The average property tax on Bordage St is 374yr and the average house or building was built in 2009. The Director Real Estate Transfer Tax will play an instrumental role in the development of the Real Estate Transfer Tax section of the Property Tax Consulting Practice.

And Mortgages and written obligations to pay money such as promissory notes. Assuming the responsibilities for new property. Charles Avenue New Orleans LA 70130 Phone.

For example if a property is purchased for 200000 first divide the sales price by 100 then multiply by 70 for a total of. In Florida transfer tax is called a documentary.

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Florida Lady Bird Deed Form Get An Enhanced Life Estate Deed Form

Free Real Estate Purchase Agreement Rocket Lawyer

What Are Transfer Taxes Mansion Global

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/URGPECSXRNDTNFO3IH6EIDFN64.jpg)

Philly Misses Full Bounty Of Shops At Schmidts Sale As Transfer Tax Shortfalls Persist

Property Transfer Among Family Members H R Block

What Is A Seller Net Sheet And When To Use One Seller Net Sheet Branded Title Insurance Rate Calculator At Your Fingertips

Transfer Fee Evidence Local Option For Housing Affordability

Should I Transfer The Title On My Rental Property To An Llc

Selling Property In Florida As A Non Resident

Transfer Tax And Documentary Stamp Tax Florida

Ny Taxes Driving Florida Real Estate Agent Fox Business

Florida Documentary Stamp Tax Guide 2022 Propertyclub

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Real Property Transfer Taxes In Florida Asr Law Firm

Real Estate Transfer Tax Ny State Propertyshark Com